When beginning the journey into multifamily investing, an important step is becoming familiar with terms and calculations often used in the space. By better understanding these concepts, an investor can be more prepared to make informed decisions when comparing and investing in multifamily syndications. To assist investors in getting started, we’ve defined and clarified a few of the most prevalent phrases found in almost every syndicated property offering:

General Partners and Limited Partners

Multifamily syndication typically has two types of partners: General Partners (GPs) and limited partners (LPs). The GPs are the managing partners or group that lead the syndication and are responsible for the legwork of the investment: sourcing the deal, securing any lending/ debt needed, raising capital, and day-to-day operations after the purchase of the asset are made. The LPs are investors who provide capital but do not have an active role in management or voting and quite often are shielded from most of the day-to-day liabilities of the asset while still participating in the benefits. In most cases, limited partners are passive investors who rely on the experience, expertise, and legwork of the general partner to generate hands-off returns. While this arrangement can provide significant benefits for both parties, it is important to investigate and understand the roles and benefits of each investment.

Cap Rate

A capitalization rate often called a “cap rate,” is a ratio used to estimate the potential return on investment of a property. This metric is calculated by dividing the net operating income (NOI) by the current market value (in some cases defined by the purchase price) of the property. For example, if a property has a calculated annual NOI of $100,000 and a sale price of $1.5 million, its cap rate would be 6.6% ($100,000/ 1,500,000 = .066). Or, if an investor is investigating what a reasonable market rate for a property should be, this equation can be flipped. If said investor knows that the local cap rate is 8% (or an “8 cap”) and the NOI is $100,000, the market rate for that property can be calculated to be $1.25 million (100,000/ .8 = 1,250,000). Cap rates are important to investors because they provide a quick way to compare opportunities and provide a back-of-napkin ability to calculate what a fair market value for a property should be in general terms. A higher cap rate typically indicates a higher potential return, making it potentially more attractive to investors (albeit with likely higher risk involved). Additionally, in the realm of value-add investing, forced equity is calculated utilizing the cap rate. Suppose an investment group substantially improves the operations of the above investment property, and by doing so increases the NOI from $100,000 to $150,000 annually. At an 8 cap, this means that the property has increased in value by $600,000 (150,000/.08= $1,875,000) simply by increasing the NOI. There are many nuances to how Cap Rates (as well as NOI) are assigned/ calculated, so it is important to understand exactly how quoted investment metrics are being pulled together and what is affecting the cap rate locally.

Cash-on-Cash

The cash-on-cash (or CoC) return is an operating metric that measures the amount of cash flow an investment generates in relation to the amount of cash invested. To calculate an investment’s cash-on-cash return, the pre-tax cash flow of the investment is divided by the total amount of cash invested for a given period (usually one year). For example, if the total cash investment on a property is $2,000,000 and it generated $150,000 in positive cash flow for the year, the Cash-on-Cash return would be 7.5% ($150,000/$2,000,000 = 0.075). The higher the percentage, the more profitable the investment. Keep in mind, however, that this metric does not take into account the time value of money or the appreciation of the property. A true cash-on-cash metric only looks at a single year of an investment, and not the entire investment. An “average cash-on-cash” metric will look at the average cash-on-cash over the expected term– but may skew some investment years (especially early on in the investment, when cash distributions are likely to be lower). In this way, the metric works as a good indicator of what a return on investment may look like, but may not paint the full picture alone.

Internal Rate of Return

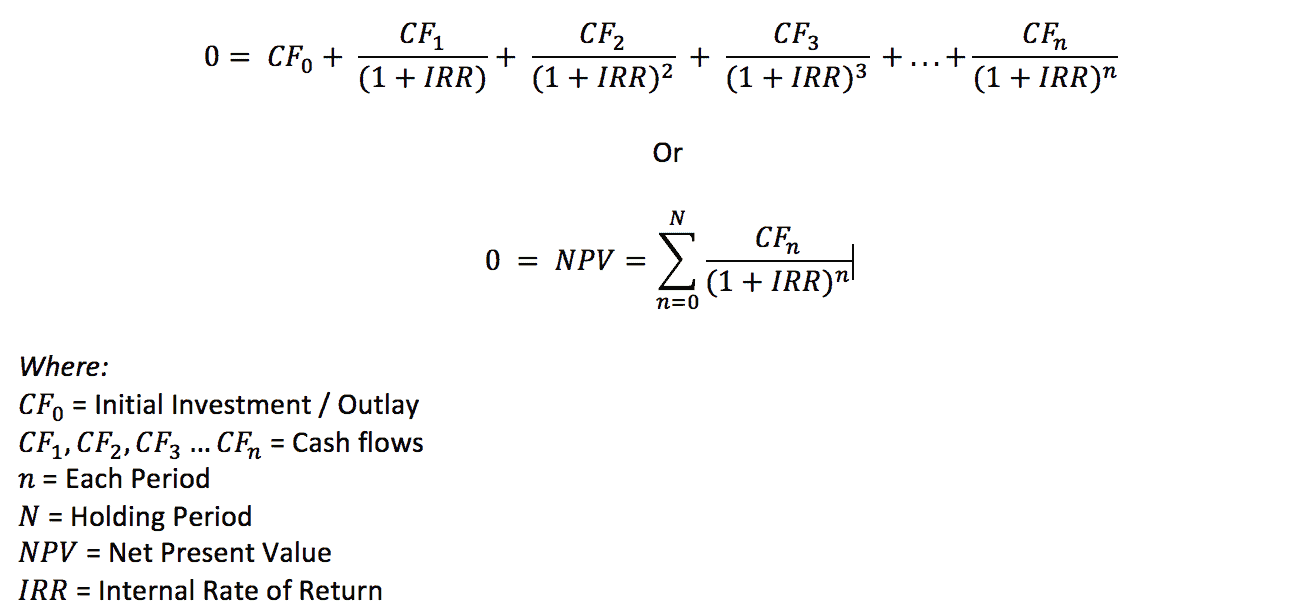

IRR, or Internal Rate of Return, is a metric used by investors to calculate the time-adjusted returns of an investment. IRR is calculated by taking into account the cash flows from an investment over time, and then discounting those cash flows back to a net present value of zero:

This is a complicated metric that is normally calculated within a formula in return evaluation spreadsheets. Stated much more simply, IRR is a numerical value that helps investors calculate not only how much money will be returned, but also when money will be returned. To do this, the calculation starts with the investment at zero and compiles distributions (cash flow and any other proceeds from refinance or sale) into one return metric that is adjusted based on when those distributions were received. For many investors, cash flow produced by an investment that can be re-utilized throughout the lifespan of the investment is more favorable than one lump-sum payment at the end of an investment. This is also referred to as the “time-value” of money. As an example, assume an investor is comparing two different deals. Deal A estimates a return of $50,000 on investment, by providing a regular cash flow distribution and the remainder paid upon sale of the asset. Deal B also estimates a return of $50,000, but does not offer any distributions– only one payment at the end of the lifespan of the offering. Although both deals return $50,000 on the initial investment, Deal A will have a higher IRR, since the deal returned cash along the way, and the investor can theoretically put that cash back to work (to make more money). That stated, the IRR calculation (like any other) has its limitations and has difficulty comparing different investments of varying time horizons, as well as projects with varied size/ scope in some instances. IRR is a great metric to be utilized in conjunction with several others to round out the investment picture.

Accredited and Sophisticated Investors

The terms “accredited investor” and “sophisticated investor” sometimes are used interchangeably to refer to high-net-worth individuals who are considered to be experienced and capable of understanding complex investment products. That said, there are some very specific differences, and these are important to understand, especially within the multifamily syndication space. In general, there are more investment opportunities available to accredited investors than to sophisticated investors. The goal of the SEC here is to improve investor protection in unregistered private offerings by restricting access to some investments only to those who have been certified as qualified.

SEC Rule 501 of Regulation D defines an accredited investor as “a natural person who has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year,” or “a person who has a net worth over $1 million, either alone or together with a spouse.” An individual can also qualify as an Accredited Investor if he or she works in certain professions, such as a registered broker-dealer, investment advisor, or SEC-registered exchange.

A sophisticated investor is much less defined by SEC rules than an Accredited Investor. The term is used in SEC Rule 506(b) of Regulation D to refer to investors who are “deemed to be knowledgeable and experienced in financial and business matters” and “capable of evaluating the merits and risks of a prospective investment.” In the United States, sophisticated investors have fewer investment possibilities than accredited investors. One notable advantage of being deemed “sophisticated” is the opportunity to invest in Rule 506(b) offerings, which are not available to ordinary investors. This regulation allows the offering to be opened up to a limited number of sophisticated investors to participate alongside accredited investors. There are some very specific and important rules governing 506(b) offerings, and investors and opertators need to understand these in totality. Many accredited investors begin as sophisticated investors within 506(b) offerings, building up wealth and knowledge to eventually meet the accredited investor status.

We hope this article has helped to clarify some of the most common terms used in multifamily syndication. There are many more terms and concepts to learn, and it is important to continue expanding your knowledge in order to be successful in this space. We would love to help you on your journey, and invite you to reach out to us directly on our Facebook page to continue the conversation.

DOWNLOAD THIS ARTICLE AS A PDF HERE!